2023 Staffing and Recruiting Industry Salary Guide

As the U.S. economy grapples with inflation, talks of a recession, layoffs, downsizing, and foreign conflicts, our post-pandemic dreams of the Roaring Twenties have quickly gone up in smoke.

As the U.S. economy grapples with inflation, talks of a recession, layoffs, downsizing, and foreign conflicts, our post-pandemic dreams of the Roaring Twenties have quickly gone up in smoke.

But how do all these factors impact your staffing firm? Our team at echogravity did a deep dive into the latest published reports and publicly available data to give you the answers.

In this salary guide for staffing firms you’ll find information on projected starting salaries and employment trends for recruitment firms. We also take an in-depth look at the current state of the staffing industry and how external factors and geopolitical activity will weigh on the U.S. economy in 2023 and beyond.

2023 Salary Averages

For many staffing firms, the “producer roles” are where companies spend a lot of time trying to nail down compensation best practices. As staffing firms have evolved from a sales-focused environment to a place where a multitude of roles are required to scale to a medium-sized firm or large-sized firm, different skills and resources are required to lock down top talent without breaking the bank.

Our experience tells us firms that provide competitive base salaries and frequent commission payouts give their team a regular reminder of their value—and a reason to stay. While money isn’t the main reason people get out of bed in the morning, compensation does enrich employee engagement, especially in the staffing industry.

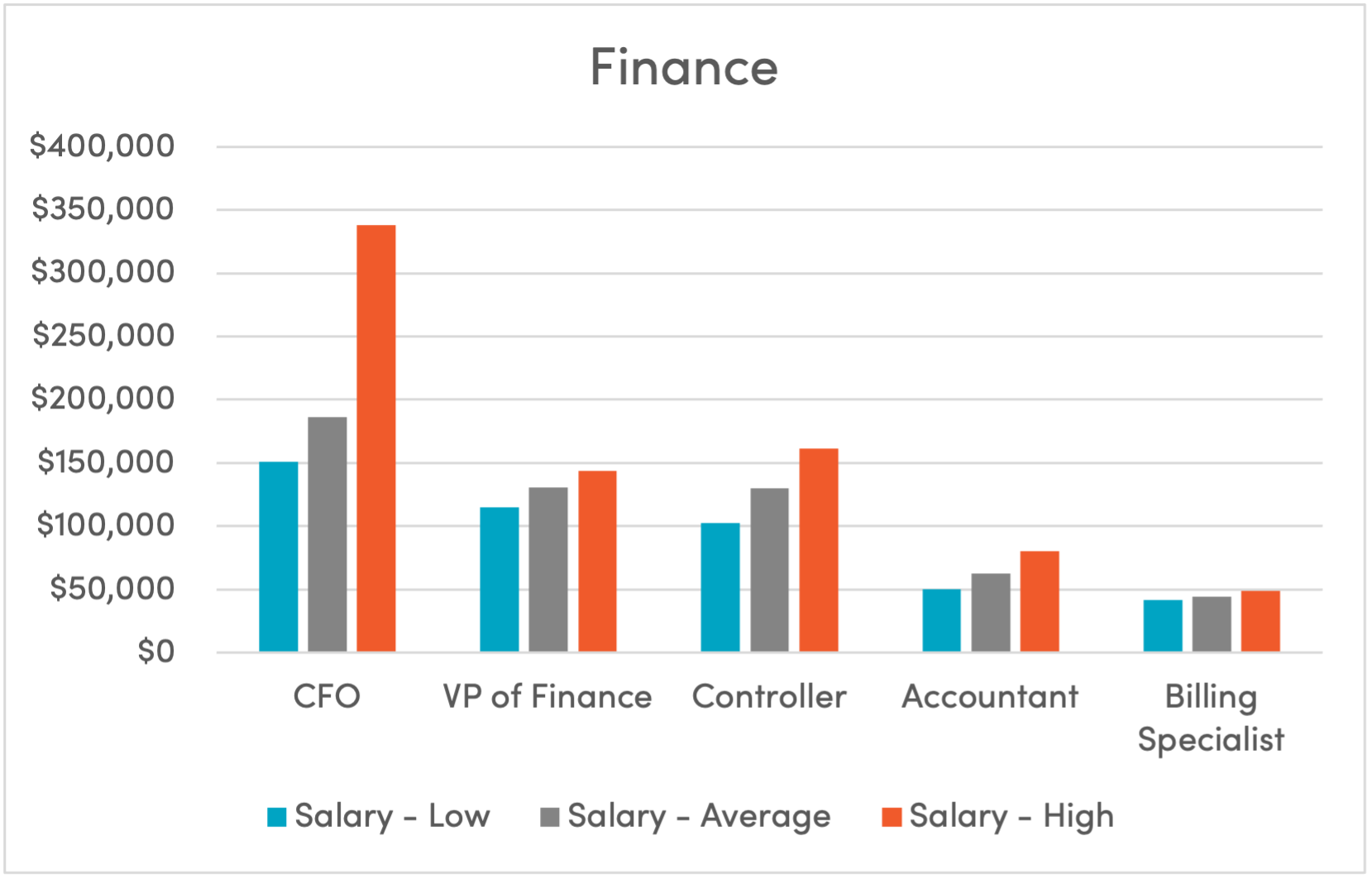

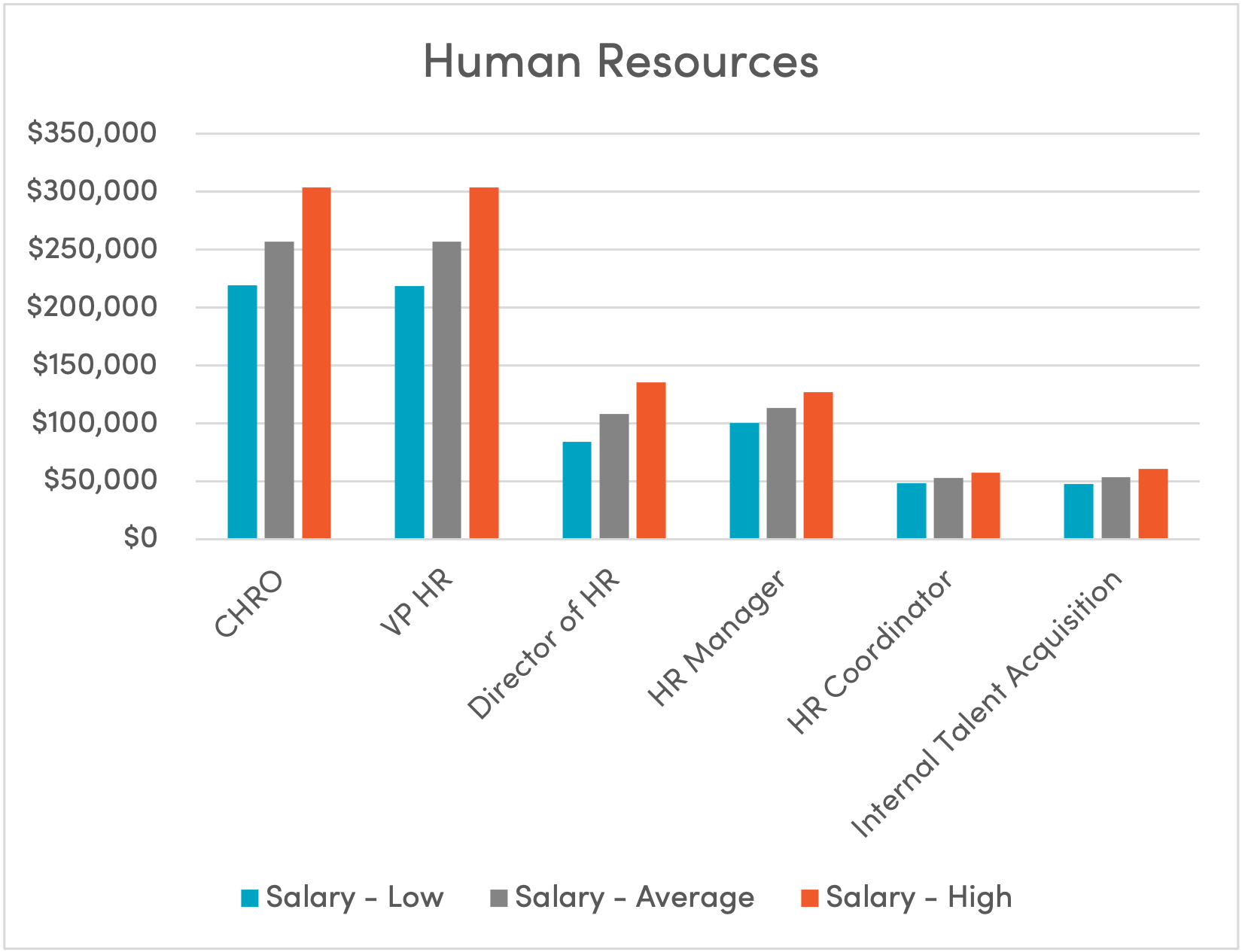

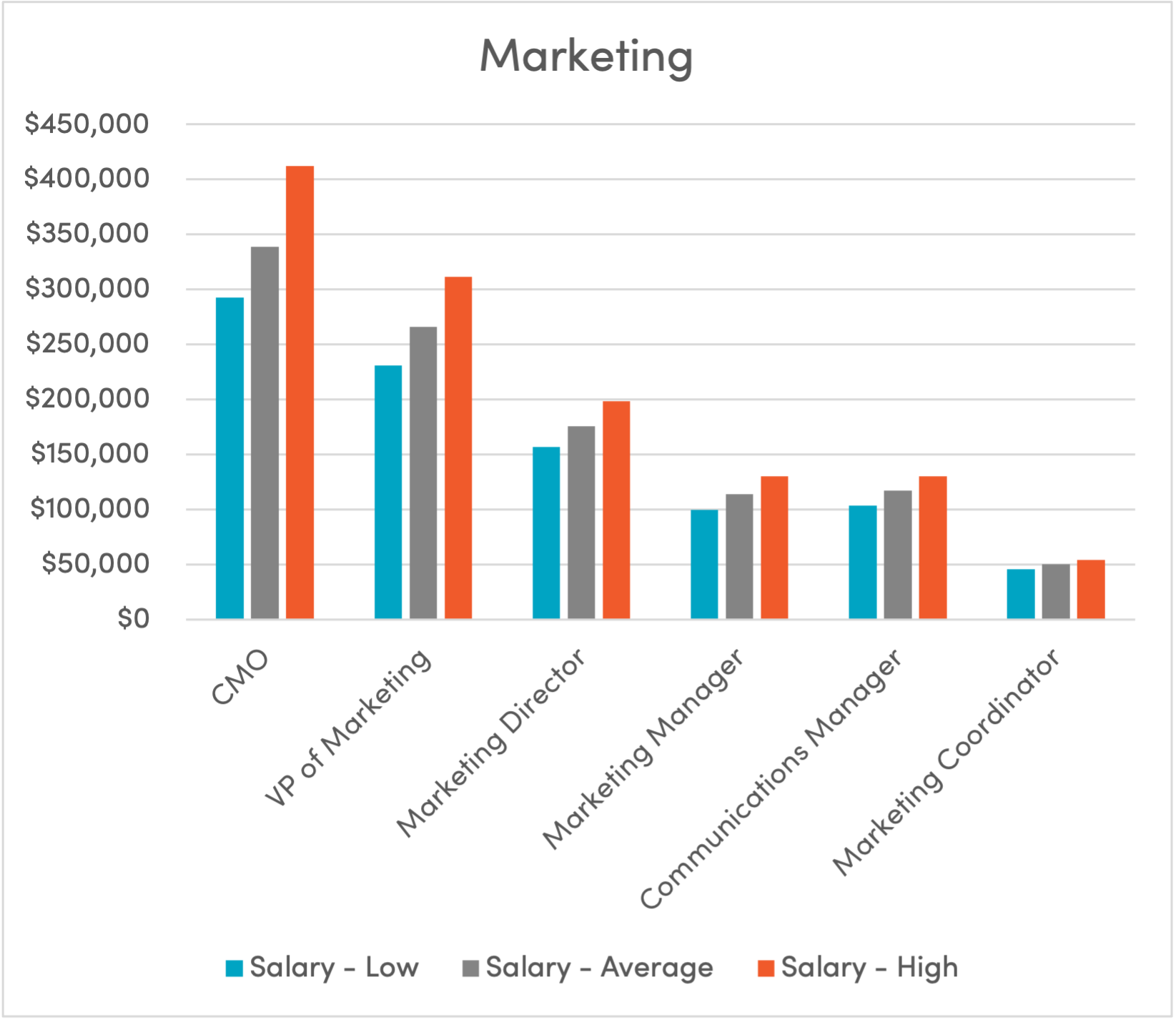

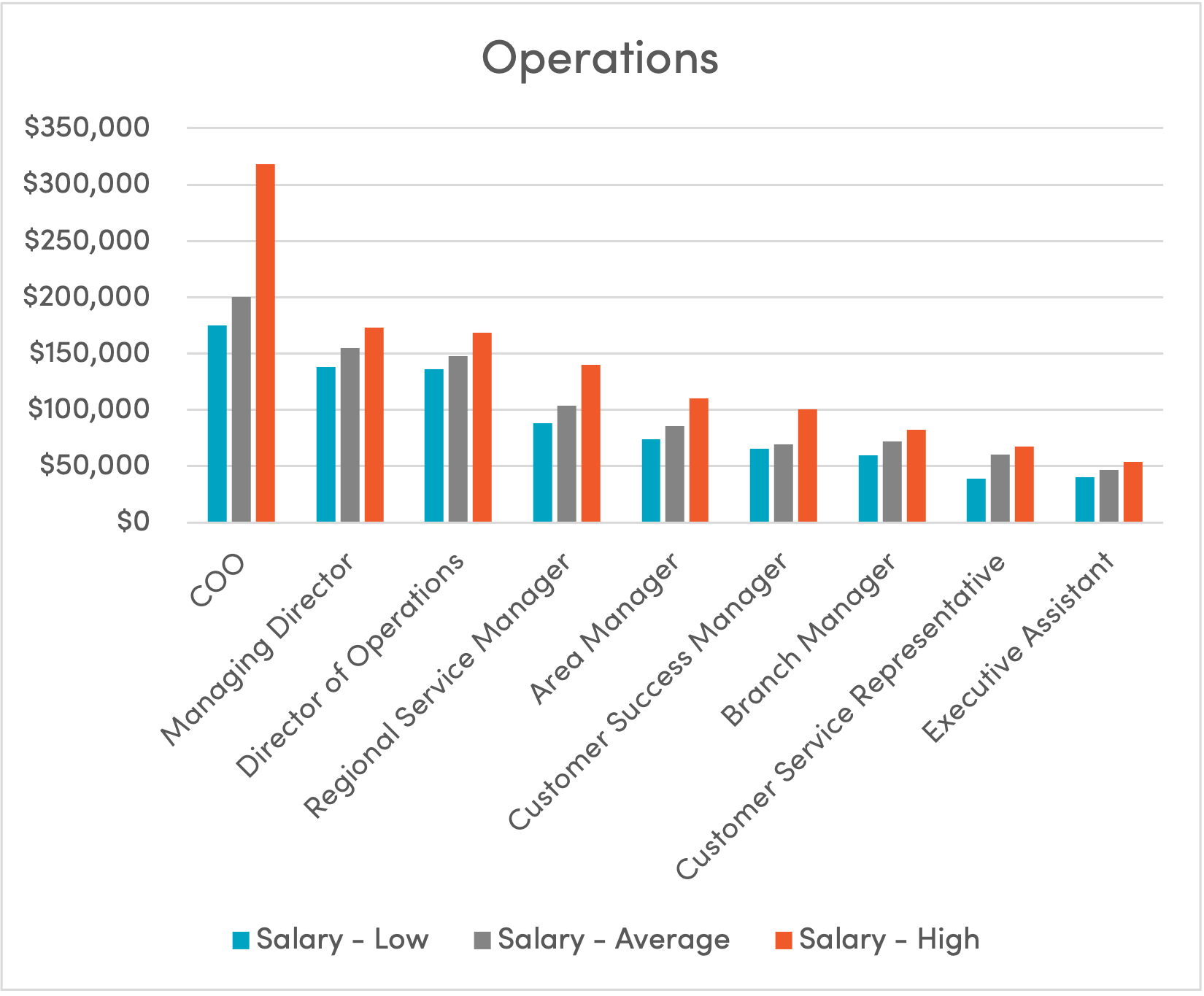

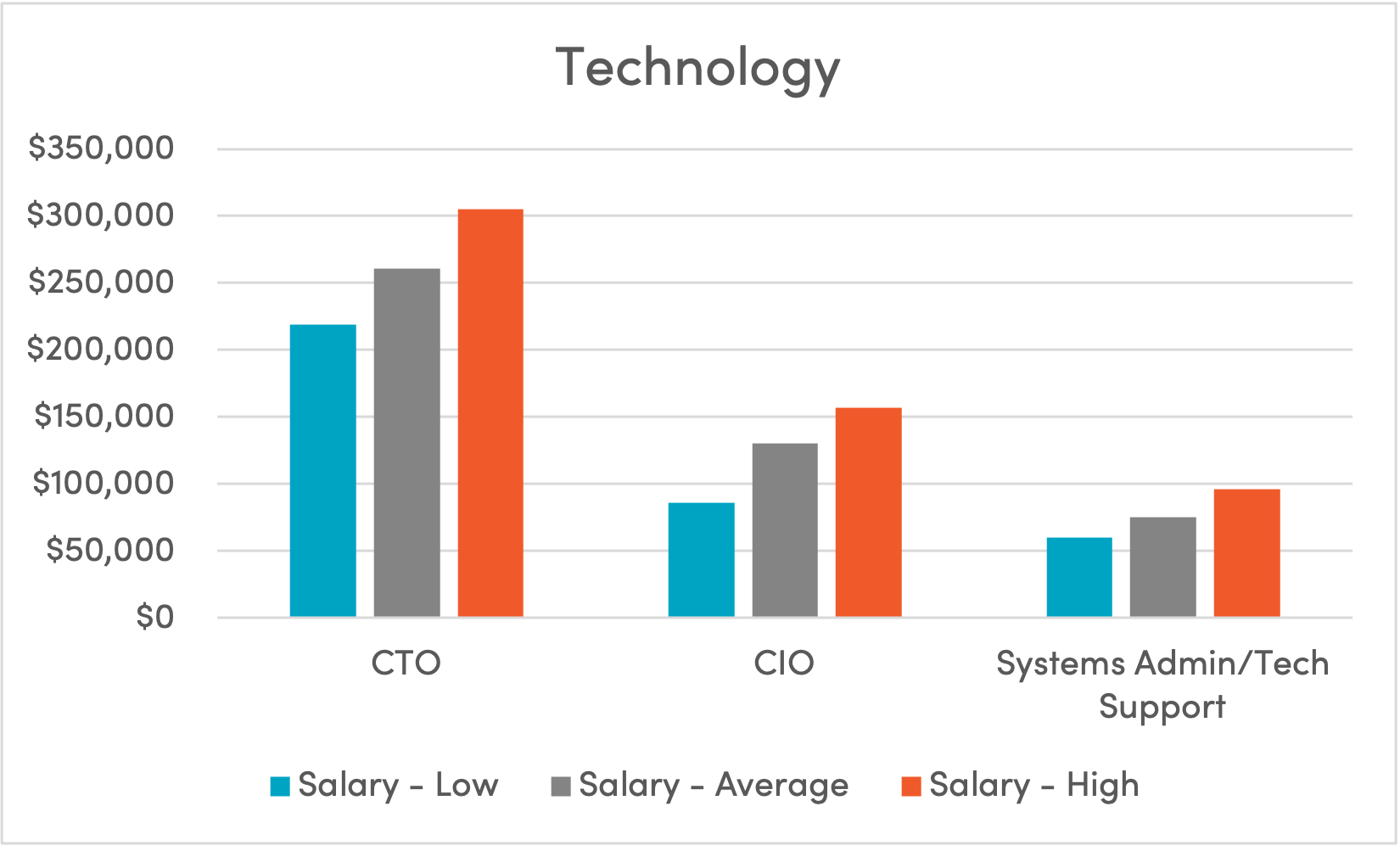

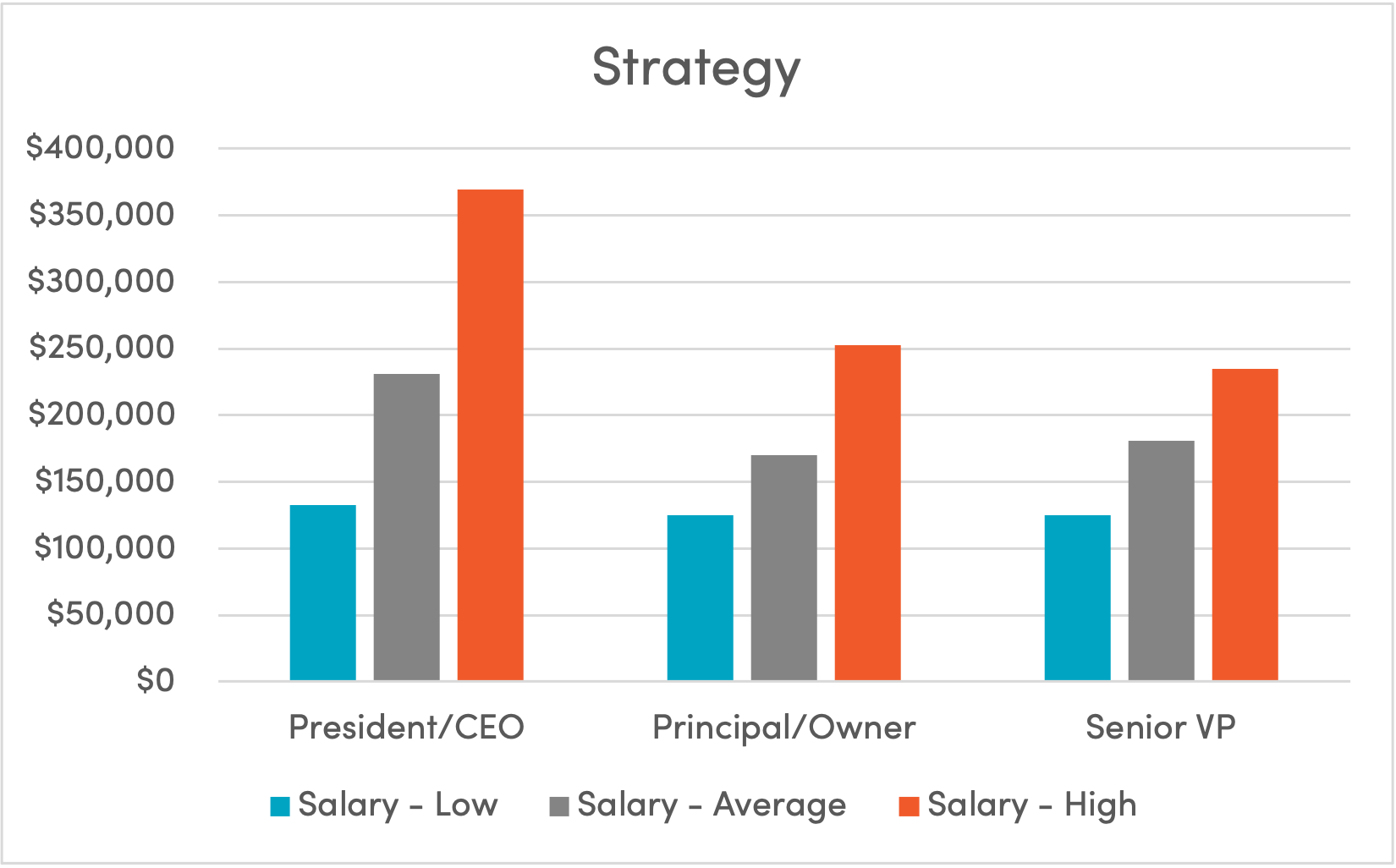

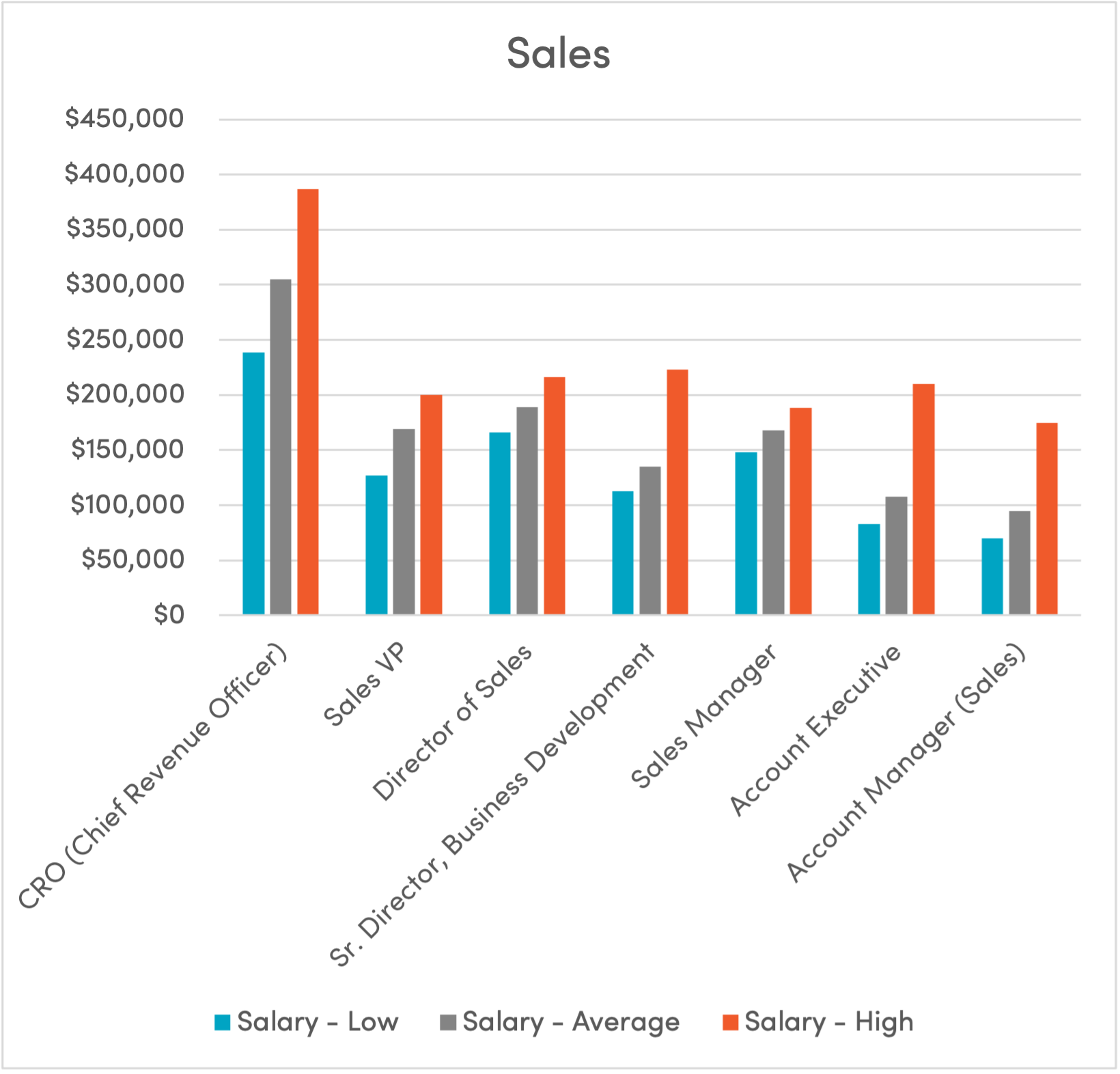

It’s more important than ever to stay up-to-date on salary averages and trends for each position you hire in your own company, and those you fill for others. Below you’ll find our predicted averages for 2023 staffing industry salaries.

Salaries by Staffing Function

The Current State of Staffing by Industry

Information Technology Staffing

Big tech layoffs have been dominating the headlines for months, adding fuel to the rumors of an impending recession. This comes on top of existing supply shortages in the semiconductor industry that aren’t projected to recover until at least 2024.

However, while industry giants like Microsoft, Tesla, Meta, Uber, Gemini, and Netflix have been shedding headcount and rescinding job offers, the demand for IT talent is still strong, particularly in the SMB market, according to TechServe Alliance.

The urgency for tech workers comes on the tails of the pandemic, when digital transformation accelerated at unprecedented rates, and, as many experts have suggested, every company essentially became a tech company. Ultimately, it seems, IT has become somewhat recession-proof as a result.

This is great news for staffing firms that play in the IT field. In fact, at the end of 2022, revenue in the IT staffing sector was up 10% year over year. The vast majority of clients will still be struggling to find top tech talent in this competitive employment landscape.

The IT unemployment rate remains below the national average, continuing the trend of a candidate’s market. But staffing firms with rich networks and advanced recruitment strategies will be able to tap into the talent pool despite competing job offers and increasing salaries.

Supply Chain & Light Industrial Staffing

It’s safe to say the supply chain and light industrial industries have received the brunt of the post-COVID effects on our society—effects consumers often can’t see, such as:

- Inventory shortages and material scarcity

- Fulfillment and transportation difficulties

- Rising commodities prices

- Trouble predicting demand

- Talent shortages

As a staffing firm in the supply chain and light industrial (LI) space, you’ve likely found yourself directly affected by the complexities of the industry’s problems. With countless job orders, shrinking margins, and a talent shortage, it’s become increasingly difficult to solve those challenges for LI clients.

To keep up with the demand for talent in this increasingly talent-short industry, your firm will have to offer unique benefits (or encourage your clients to) in the coming months to attract candidates quickly—or at all. Firms with clients in supply chain/LI must:

- Follow pay trends closely and encourage salespeople and account managers to be transparent when a client’s proposed salaries won’t attract the candidates they want

- Emphasize viable career paths for candidates

- Address candidate safety concerns

- Stay up to date on the latest tech improvements and highlight those for candidates

Emphasize any and all high-quality benefits packages and above average salary offerings. Be prepared to push back against clients offering low wages, since it’s highly unlikely you’ll be able to find candidates who are willing to take roles for $12 per hour anymore; Amazon is paying $18 per hour and fast-food giants like McDonald’s are paying more as well.

Finally, candidates who built their careers in the light industrial industry now have a greater ability to shop around for jobs in other industries and may likely move into a food and beverage or retail opportunity. Light industrial employees expect to be treated as the essential workers they are. Showing candidates these roles have potential for a rewarding, long-term career path is the key to marketing careers and making placements.

Healthcare Staffing

The healthcare industry has faced enormous pressure in the last few years. Hospitals have recovered quite a bit in 2022; however, they are still not close to pre-pandemic levels of profitability and efficiency, meaning the rollercoaster healthcare staffing firms have been on in recent years will likely not stop any time soon. In 2023, we expect:

- High levels of nurse turnover

- Medical professional burnout

- Health systems more reliant on temporary and travel nurses (who typicallyrequire higher pay)

- Rising pay rates

- Growth of healthcare staffing platforms

The recent industry pressure has encouraged an impressive amount of innovation and growth in healthcare, introducing new competitors to traditional staffing firms. Staffing platforms like Upwork and Fiverr have boomed, growing over 317% in 2021 and owning 22% of the healthcare staffing market as of mid-2022. Using employer-of-record models, these platforms connect workers directly with clients, cutting out a lot of the manual tasks usually performed by healthcare staffing firms.

With recruiters struggling to meet the incredible demand for talent, and healthcare workers wanting more control over their job stipulations, these platforms allow candidates to bypass waiting on a recruiter and find jobs as easily as they can order a burger from Uber Eats.

For traditional healthcare staffing firms, these platforms create a new challenge. If these platforms are grabbing up all the talent, how can your recruiters convince candidates to work with them in order to fill your rising job orders?

Unless you’re ready to transition your firm into platform-based staffing full-time or use an omnichannel approach, it’s vital you focus your messaging and human-touch differentiators against these new platforms. No tech can truly mimic the signature white glove service your recruiters can offer candidates. Automate where you’re able, so your recruiters can dedicate as much of their time as possible to creating strong relationships with jobseekers.

How Much Will the Global Economy Pressures Weigh on Staffing Firm Demand in 2023?

In December 2022 alone, the U.S. added 223,000 jobs to the economy, bringing the unemployment rate down to 3.5%. Inflation is still hanging on at 6.45% for December 2022. Though inflation seems to be cooling, these factors are still warranting continued interest rate hikes from the Federal Reserve in an attempt to slow economic growth and prevent a recession.

Borrowers could see mortgage rates hover around 5% well into 2023. If this soft landing works as the Fed intends, it will gradually restrain the level of spending in the economy, causing inflation to drop. Unfortunately, this outcome is not guaranteed; in years past, when the Fed has raised interest rates to fight inflation, it has caused a recession. A Bloomberg poll of economists in mid-June found they expect the Federal Reserve to cut interest rates in late 2024.

Recruiters should take advantage of the current market. With job openings holding steady, rising wages, and inflation continuing to limit consumer buying power, candidates are more likely to continue looking for new opportunities.

Further complicating the economic situation is the war against Ukraine, making it harder for the Fed to engineer a soft landing. Global growth projections have significantly dropped since the beginning of the war, and any unforeseen developments in the conflict could heighten geopolitical risk and worsen the war’s economic effects on the U.S.

Expect New Technology Improvements

In the coming years we expect to see more jobs being automated, and by the end of 2023 Gartner expects 40% of all enterprise workloads to be deployed in cloud infrastructure and platform services, up from 20% in 2020. Through 2024, enhancements in analytics and automatic remediation capabilities will refocus 30% of IT operations efforts, from support to continuous engineering.

New tools and technology (think AI and ChatGPT) will allow all industries— healthcare and IT especially— to continue advancing virtual services. IT teams will have to focus on integrating new technologies to reliably manage big data across a disparate environment. This will likely create new jobs for those with experience in data science and database administration; business intelligence, analysis, and reporting; and cloud architecture and operations. Staffing firms as a whole should familiarize themselves and their individual teams with the latest technology available in their industries to maintain a competitive advantage.

Remote and Hybrid Work Will Continue

Remote work is predicted to continue and increase through 2023 and beyond. Ladders says 24% of all professional jobs in the U.S. and Canada are hired for permanent remote work now and this number will increase to 25% by the end of 2022 and continue to rise in 2023. With employees being free to work from anywhere, the growing popularity of remote work may bring an influx of high-earning, well-educated professionals to smaller cities across the U.S. that previously weren’t home to citizens with such high paying jobs.

This shift to working from home allows for more than avoiding an inconvenient commute—it has the power to transform communities. Not to mention, this is huge for recruiters! It opens them up to a variety of different candidates who might have previously felt too distant to contact.

According to many staffing and recruiting leaders, the candidate-driven market is likely to stick around through 2023. A survey by PwC of more than 52,000 workers in 44 countries indicates the Great Resignation is set to continue, with one in five saying they are likely to switch jobs in the next year. The survey ultimately concludes that higher pay, fulfilling daily duties, and a friendly, relaxed work environment are the main factors pushing employees to change jobs.

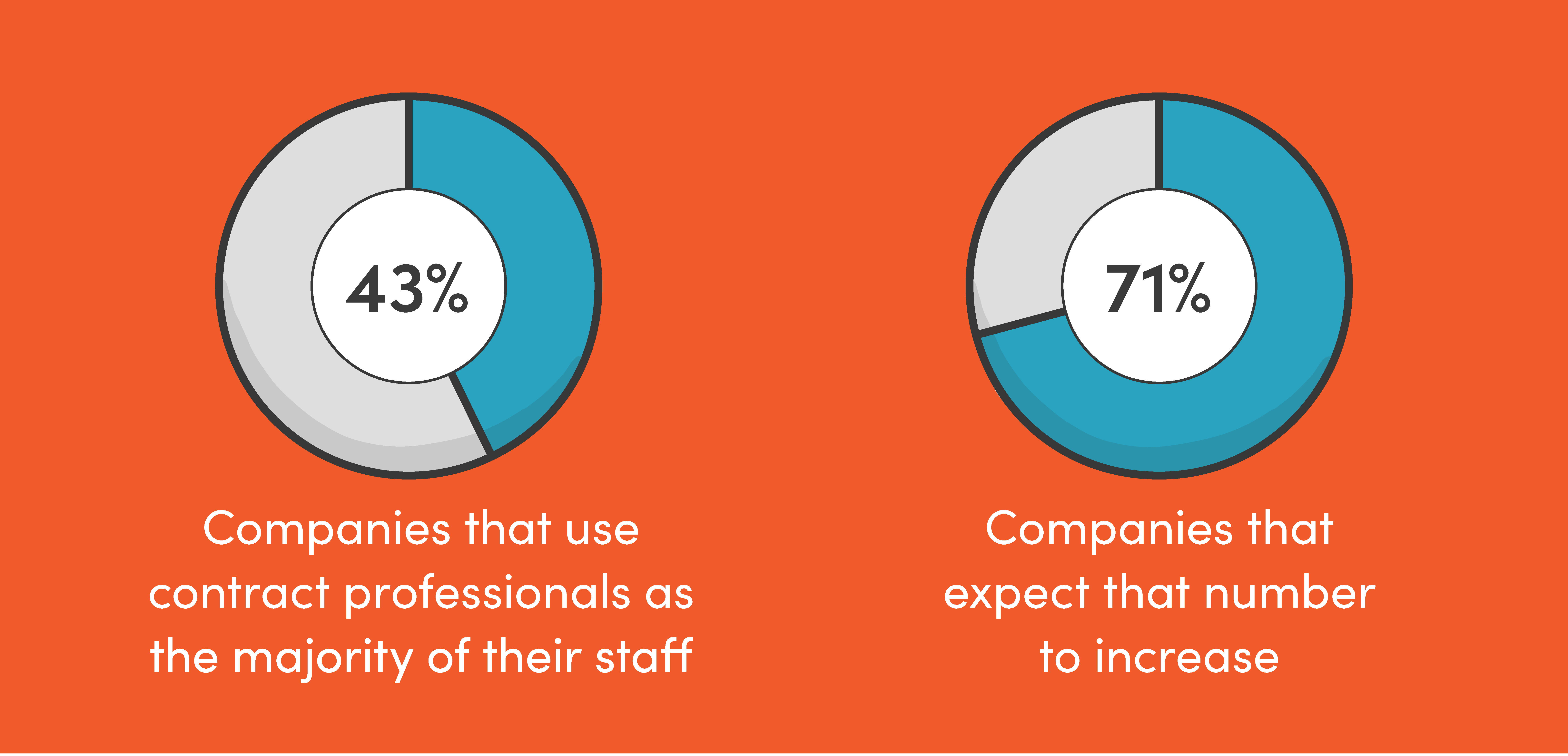

Expect to See More Contract Positions as Inflation Remains

Average raises are predicted to be 4.1% in 2023, which is less than half the headline rate of inflation at 9.1%. While 4.1% is significantly higher than a standard 3% cost of living adjustment, those who receive a raise less than 4.1% will effectively see their pay cut due to lower purchasing power, unless the inflation rate goes down to 2.4% by December of 2023. This makes offering candidates new opportunities far more compelling; recruiters should play up cost of living as well as engage challenges and job stability.

As goods and services become more expensive, and businesses can no longer increase wages, many companies will try to get ahead of the game by hiring more contract workers to cut hiring costs. According to a Robert Half survey:

Seeking out clients who need a team of contractors will likely give your staffing firm a competitive edge in the years to come.

Challenges and Opportunities

Demand for workers still remains near record highs, with 10.5 million job openings at the end of November 2022. Additionally, some 5.9 million Americans quit or changed jobs that month, according to the latest report released by the Bureau of Labor Statistics, as workers continue using their leverage in an economy where job openings outnumber job seekers. Employees at all levels are more in control of their careers than ever before—and they expect more from their employers than in years past.

BLS data from December also makes it clear businesses are desperate to keep the employees they do have, with layoffs and discharges holding steady at just 1.4 million. How can staffing firms capitalize on a candidate-driven market and bring clients competitive talent who can help them achieve their goals?

As job seekers continue to raise their standards, it is imperative staffing firms provide an exceptional candidate experience if they want to engage with and deliver top talent. So, how do you do that? Here are the top three ways:

A high level of attention to detail in these areas sends a positive signal to candidates that recruiters have their best interest in mind.

If your staffing firm is struggling to reach and engage your desired audience in this challenging job market, echogravity can help. Our team executes impactful marketing initiatives in alignment with your unique business objectives. To learn more about all of the services we offer, visit us at https://echogravity.com.